Defaults and Returns in the High Yield Bond Market the Year 2003 in Review and Market Outlookã¢â‚¬â

Come across Table of Contents

What is a high yield bail?

A loftier yield bond – also known as a junk bond – is a debt security issued by companies or private equity concerns, where the debt has lower than investment grade ratings. It is a major component – along with leveraged loans – of the leveraged finance market.

For a brief explainer on how the market works, bank check out this video, courtesy LCD and Paddy Hirsch.

Want a bigger-picture? Paddy'south got a great video on how leveraged finance works. You know, as in those billion-dollar LBOs yous hear about (they often involve junk bonds).

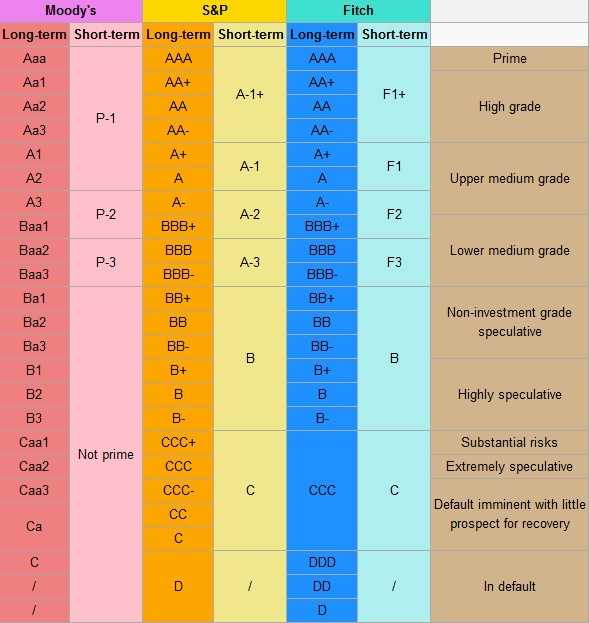

Not-investment grade vs investment grade

Non-investment grade ratings are those lower than BBB- (or its equivalent), while an investment grade rating (or corporate rating) is BBB- or higher.

A non-investment grade rating is important equally it suggests a greater chance of an issuer's default, wherein the company does not pay the coupon/interest due on a bond or the principal amount due at maturity in a timely manner.

Consequently, not-investment grade debt issuers must pay a college interest charge per unit – and in some cases they must make investor-friendly structural features to the bond agreement – to recoup for bondholder adventure, and to attract the interest of institutional investors.

A ratings breakdown:

Background - Public v private

Some background is in gild. The vast bulk of loans are unambiguously individual financing arrangements between issuers and lenders. Even for issuers with public disinterestedness or debt, and which file with the SEC, the credit agreement becomes public only when it is filed – months later closing, usually – every bit an exhibit to an almanac report (ten-K), a quarterly report (10-Q), a current report (8-Chiliad), or another document (proxy statement, securities registration, etc.).

Beyond the credit agreement there is a raft of ongoing correspondence between issuers and lenders that is fabricated under confidentiality agreements, including quarterly or monthly fiscal disclosures, covenant compliance information, subpoena and waiver requests, and financial projections, also as plans for acquisitions or dispositions. Much of this information may be cloth to the financial wellness of the issuer, and may exist out of the public domain until the issuer formally issues a printing release, or files an eight-K or some other document with the SEC.

What is a junk bond?

"Junk bail," or "speculative-form bail" merely are other names for a high yield bail. These terms helped give the asset class some negative connotation in its more determinative years. The asset form has matured into a large, liquid market place, however, which now attracts a broad swath of investors and multitudes of issuers.

How large is the loftier yield bond market?

After growing rapidly over the past 10-xv years, loftier yield now comprises roughly xv% of the overall corporate (investment grade) bond market, which itself is estimated at roughly $8.ane trillion, trailing the U.Due south. Treasury market ($12.7 trillion outstanding) but larger than the municipal bond market ($3.7 trillion outstanding), according to second-quarter 2015 estimates by industry trade group Securities Industry and Financial Markets Association (SIFMA).

Market place history

Corporate bonds accept been around for centuries, but growth of the non-investment-grade market did not begin until the 1970s. At this time, the market was composed primarily of companies that had been downgraded for various reasons from investment-grade, becoming "fallen angels," (you tin read virtually those hither) and which continued to issue debt securities.

The starting time existent boom in the market place was in the 1980s, however, when leveraged buyouts and other mergers appropriated high-yield bonds as a financing mechanism. Probably the most famous example is the $31 billion LBO of RJR Nabisco by private disinterestedness sponsor Kohlberg Kravis & Roberts in 1989 (the financing was detailed in the acknowledged book Barbarians at the Gate).

The financing backing the deal included v high-yield issues that raised $4 billion. While certainly there have been huge deals in market since that transaction, it'south still notable today as the 16th largest high-yield offering on record, according to LCD.

Since then, more companies have plant acceptance with a growing pool of investors equally the high-yield market developed. Loftier-yield bonds still are used to finance merger and acquisition activity, including LBOs (yous'll note that most of the deals in the table in a higher place backing leveraged buyouts), and oftentimes back dividend payouts to private equity sponsors, and the market place still supports funding capital-intensive projects, such as telecommunications build-out, casino development and energy exploration projects.

These days, though, the marketplace besides is a skillful deal of its own refinancing mechanism, with proceeds often paying off older bonds, bank loans and other debt.

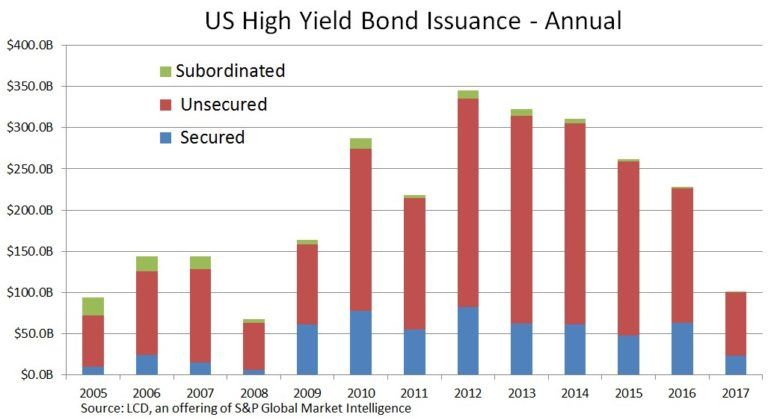

The high-yield market matured through increasing new bail issuance, which reached a peak of $287 billion in 2010, and via boosted fallen angels, almost notably Ford Motor Company and General Motors in 2005. Indeed, with the automakers' combined $80 billion of fallen angel corporate bonds downgraded into the nugget course, high-yield ballooned to roughly $1 trillion in 2006. Simply 10 years earlier, the asset class was a humble $200 billion, according to SIFMA. And with the ongoing new issuance weighed against maturing bonds and other bond take-outs, the market has held around approximately $one trillion, according to Bank of America Merrill Lynch.

Steady growth of the loftier-yield bond market saw only a few notable speed bumps. There was the savings & loan scandal in the 1980s, the correction after the "tech wreck" in 2001, and of class most recently the subprime mortgage meltdown, credit crunch and financial crisis of 2008. Issuance that twelvemonth was but $69 billion, the lowest in vii years, co-ordinate to LCD.

Loftier yield bond issuers

Companies issuing high yield bonds ordinarily are seeking money for growth (via Grand&A, maybe), for working capital and for other cash-flow purposes, or to refinance existing loans, bonds, or other debt.

Companies with outstanding high-yield debt embrace the spectrum of industry sectors and categories. There are industrial manufacturers, media firms, energy explorers, homebuilders and even finance companies, to name a few. The one thing in common – indeed the only matter – is a high debt load, relative to earnings and greenbacks menstruum (and, thus, the not-investment grade ratings). It's how the issuers got at that place that breaks the loftier-yield universe into categories.

The most frequent types of issuers are detailed below. As well, other capital-intensive businesses, such as oil prospecting, notice investors in the high-yield bond market, as do cyclical businesses, such as chemical producers.

Fallen angels

The kickoff high-yield companies were the "fallen angels," or entities that used to acquit higher ratings, before falling on hard times. These companies might find liquidity in the high-yield market and improve their rest sheets over time, for an eventual upgrade. Some fallen angels oft hover around the high-course/loftier-yield edge, and frequently carry investment grade ratings past one bureau and non-investment grade by another. These often are referred to as "crossover," "split-rated," or "five-B" bonds. Other issuers might never amend, and head further down the scale, toward deep distressed and potentially default and/or file for bankruptcy.

In that location were 26 fallen angels globally in 2016's first one-half (through June 8). Leading the pack: Fiscal institutions, mining/commodities companies, and oil & gas concerns. Of the 26 fallen angels, one-half are from the U.South.

Starting time-ups

Oftentimes, high-yieldissuers are commencement-up companies that demand seed capital. They do not take an operational history or balance canvass stiff plenty to attain investment form ratings. Investors counterbalance heavily on the business organization program and pro forma financial prospects to evaluate prospects with these scenarios. Telecommunication network builds and casino construction projects are examples.

Defalcation get out

Bankruptcy get out financing can be found in the high-yield market. Publisher of the National Enquirer American Media and automobile-parts company Visteon are recent examples. Both were well received in marketplace during the starting time half of 2011 and secured the get out financing despite past investor losses with the credits.

LBOs

Leveraged buyouts (LBOs) typically use high-yield bonds as a financing mechanism, and sometimes the private investors will use boosted bond placements to fund special dividend payouts. This office of the market saw explosive growth in 2005-06, amongst a buyout boom not seen since the late 1980s, so once more in the 2005-2007 bubble, only to fizzle in the ensuing crisis. Indeed, LBO-related high-yield issuance peaked at $51 million 2007 only to slump to nothing in 2009. It returned in 2010, though certainly not to the pre-Lehman heights.

High yield bail investors

Investors in high-yield bonds primarily are nugget-management institutions seeking to earn higher rates of return than their investment-form corporate, government and greenbacks-market place counterparts. Other investors in high-yield include hedge funds, individuals and arrangers of instruments that pool debt securities. Some mutual investor groups:

Insurance companies

Insurance companies invest their own capital and account for effectually 29% of the investment community. These accounts encompass insurance and annuity products.

Common funds

Mutual funds represent approximately 13% of the investor pool. These institutional investors might be managing traditional, long-only high-yield funds or portfolios that invest only in high-yield securities, but via both long- and short-positions. Likewise, at that place are corporate bail funds that invest in both high-yield and high-class bonds, and general fixed income funds that hold positions across corporate, government and municipal securities segments.

Pension funds

Pension funds account for roughly 28% of the high yield investor universe. They seek greater render on the retirement coin entrusted to them than what's being paid out to retirees. Alimony funds are trustees for the retirement money and act under prudent investment rules, which vary state to state.

CDOs/Collateralized Debt Obligations

Collateralized Debt Obligations, or CDOs, once comprised as much as xvi% of the market. These packaged debt instruments invest in a pool of securities for a lower take chances of default. Thus, the pool of bonds, or handbasket of securities, receives college credit ratings. There are bail-only instruments known as CBOs, loan-only instruments known as CLOs and packages of both, which are generically described as CDOs. This segment of the investor base grew rapidly in the first half of the 2000 decade, only to wither in the credit crunch. Every bit of 2012, it is unclear how much of the high-yield market place is held in CDOs.

ETFs/Substitution-Traded Funds

Substitution-Traded Funds, or ETFs, accept a miniscule-however growing-presence in the high-yield market.

Recent additions to relatively plain-vanilla, wide-indexed ETFs (HYG, JNK, and PHB) include actively managed (not indexed) fund HYLD, short-tenor funds (SJNK, HYS), international funds (IHYG and IJNK), not-U.S. high-yield (HYXU), and even a contrarian, short-seller fund (appropriately, SJB, suggestive of a mandate to "short junk bonds").

Other specialty investors

The balance of the high-yield investment community comprises hedge funds and other specialized investors, both domestically and internationally, besides as individual investors, commercial banks, and savings institutions. Hedge funds had a growing presence in the high-yield market over the 2003-05 bull market place and remain entrenched.

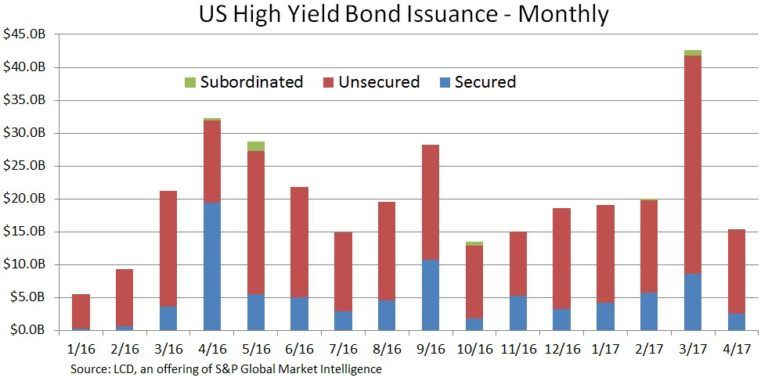

High yield bail issuance

High-yield bond issuance usually entails three steps:

- Investment bankers draft an offering proposal, or prospectus, and negotiate conditions with potential investors

- The securities are allocated/syndicated to bondholders one time terms of the offering are finalized.

- The bonds become available for purchase and sale in the aftermarket, or secondary, via broker/dealers

Oft, the process is oftentimes more than fluid and less exact than with other stock-still-income securities because the issuer has a "story" to tell to market the bargain, considering issuers and underwriters are bailiwick to more questions, given the higher risks, and because deal structure can exist reworked numerous times.

Secondary markets

Once bond terms are finalized and accounts receive allocations from the underwriters, the consequence becomes available for trading in the aftermarket.

Secondary trading of high-yield bonds is a well-established and active market place. Broker-dealers frequently traffic in the "gray market place" before the paper is "freed to merchandise," and in some cases there are grey market indications fifty-fifty before terms of the offering are finalized. For example, a trader could bespeak buying involvement at outcome price plus, or minus, valuation, such every bit a market quote "IP+1/iv" or "IP-3/8."

A move toward more transparent pricing comes on the heels of the full implementation of Trade Reporting and Compliance Engine (TRACE), the Financial Industry Regulatory Authority's (FINRA's) bond trade reporting system. Broker-dealers now study all trades of corporate bonds, including all registered high-yield problems, mostly inside five minutes of execution, although the mandatory deadline stated is 15 minutes.

FINRA was formed past a consolidation of the enforcement arm of the New York Stock Commutation, NYSE Regulation, and the National Association of Securities Dealers (NASD). The merger was approved past the Us Securities and Exchange Commission (SEC) on July 26, 2007. It is a private corporation that acts as a self-regulatory organization (SRO). Though sometimes mistaken for a government agency, it is a not-governmental organization that performs financial regulation of member brokerage firms and exchange markets, according to Wikipedia citations.

The high-yield trading published past TRACE has its roots in a NASD system, the Stock-still Income Pricing Organization, which provided hourly dissemination of prices and trading volumes of 50 liquid high-yield credits, and was known as the "FIPS 50."

With trade reporting widespread, companies such as MarketAxess Holdings and TradeWeb Markets, owned by Thomson Fiscal, in turn provide almost existent-time high-yield bond prices on their platforms.

Most bond traders take opposed increased market transparency, which erodes margins equally bonds change hands. Investors by and large say they desire to trade the newspaper only at the levels where the about contempo executions took place.

Regulators have long since said increased investor knowledge through a tool such equally TRACE can only exist a positive, arguing that retail investors should have every bit much information as institutional investors. Equally and then SEC-chairman Arthur Levitt once famously delivered in New York in 1998, "The sad truth is that investors in the corporate bond marketplace do not savour the aforementioned access to information every bit a motorcar buyer or a homebuyer or, dare I say, a fruit buyer. And that's unacceptable. Guesswork can never exist a substitute for readily available price data."

The Prospectus

Before awarding a mandate, an issuer might solicit bids from arrangers. The banks volition outline their syndication strategy and qualifications, as well every bit their view equally to where the offering will price.

The offering memorandum (prospectus or red herring) is fatigued up by the bankers alee of, or among, an issuer mandate.

The document typically will include an executive summary, investment considerations, an industry overview and a financial model. The actual bail terms have non been finalized, just often pro forma coupon rates are described to help financial modeling. The syndicate desk-bound likely volition endeavor to obtain feedback from potential investors regarding appetite for the bargain. Once this intelligence has been gathered the agent volition market the deal to potential investors.

Considering most bond offerings are sold privately under Rule 144A, this volition exist a confidential offering made only to qualified banks and accredited investors. Publicly bachelor deals volition file their prospectus with the SEC via form 424B2.

Here are ii loftier-contour Red Herrings:

- T-Mobile – $5.6B, from October 2013

- Freeport-McMoran – $6B, from March 2007

The prospectus will contain an executive summary that includes a description of the issuer, an overview of the transaction and rationale, sources and uses, and primal financials. Chance factors will be detailed, though often they are average, including such lines as "indebtedness could have a material adverse event on our financials" and "time to come strategies may non be successful." Considerations about income taxes besides might exist discussed.

The list of terms and conditions are detailed in a preliminary term sheet describing the pricing, structure, collateral, covenants and other terms of the credit (covenants usually are negotiated in detail afterwards the arranger receives investor feedback).

Commitments by the underwriters will be described. In improver to the amounts each syndicate desk-bound intends to offer accounts, fees received by underwriters from the issuer might exist detailed, ranging anywhere from 1% per $1,000 face bond to 3.25% (and sometimes higher), depending on the issuer, sector and market place weather condition.

The industry overview will be a description of the company's manufacture and competitive position, relative to its industry peers. The financial model will be a detailed model of the issuer's historical, pro forma, and projected financials (sometimes, also, management's high, low and base example for the issuer). For some institutional investors, which buy high-yield and other public securities, the fiscal model might exist stripped of projections and other non-public data.

Most new bargain marketing efforts are kicked off internally via a "teach-in" coming together, where bankers pitch the deal to sales staff, describing the terms of the offer and what purpose information technology serves. Roadshows follow, where company management provides its vision for the transaction, equally well as a business update. Well known issuers ofttimes just conduct an investor call with a management speech and investor Q&A. These "bulldoze-by" deals can be completed in a matter of hours. And of form the cyberspace roadshow has grown momentum in contempo years, with online presentations and investor Q&A.

Syndication

In that location are three primary types of syndications:

- underwritten deal

- a bought bargain

- a rate backstop deal

Less common are niche placements, similar to loan market "club deals," which are negotiated with just a handful of accounts.

Backstop bargain

In a backstop deal the underwriter agrees to purchase the deal at a maximum interest rate for a brief, merely well-defined, period of fourth dimension. This method is like to a bought-deal, but the timeframe typically is longer, by and large up to 1 week. Both seasoned issuers and unfamiliar credits may utilize this blazon of underwriting.

Underwritten bargain

These transactions are marketed on a "best-efforts" basis. The financial institution underwriting the deal has no legal obligation to the issuer regarding completion of the transaction. This is the nigh common placement method. Issuers range across all industries. First-time issuers without a proven cash flow record are especially common in underwritten transactions.

Bought bargain

A bought bargain is fully purchased by the underwriter at an undisclosed rate before marketing, and therefore is subject area to market risk. This method removes execution risk to issuing companies, which are most normally well-known and seasoned issuers. Timing is typically a twenty-four hour period or less, which helps remove some market place chance. Underwriters employ this method to compete amidst themselves for business organization, but if they are too aggressive, and are unable to fully subscribe the bargain, they are forced to absorb the difference, which they may subsequently effort to sell in the aftermarket. This is easy, of course, if marketplace conditions – or the credit's fundamentals – better. If not, underwriters might have to have a loss on the paper or concord more intended.

Loftier yield bond structure

In that location are a variety of bail structures across the landscape of high-yield, just ii characteristics are abiding:

- Coupon, or the rate of interest that the entity pays the bondholder annually

- Maturity, or when the full principal amount of the bond consequence is due to bondholders and indicative of involvement payment dates

These two characteristics define the value of each bail, and are used equally to name the individual security, such as "GM's 7% notes due 2012," or even more colloquially on trading floors, "GM 7's of 12." Other characteristics include whether, when and at what price a bail is callable past the issuer, conditions on a put by the bondholder, covenants related to financial performance and disclosure, and fifty-fifty equity warrants.

Coupon

Coupons, or involvement charge per unit, typically are stock-still for the term of debt issue and pay twice annually. The average coupon for non-investment grade companies have been in the low 8% area in contempo years, but double digits are by no means an exception.

Zero-coupon bonds

Some high yield bond issues pay no coupon at all. These deals are often called "zero-coupon bonds," "zeros," or "zips," and are sold at a steep discount to face value by companies that might not accept the greenbacks flow to pay interest for a number of years. Here, investor return comes in the form of capital letter appreciation, rather than from interest payments.

Zeros were popular with Internet commencement-ups and wireless build-out projects in the belatedly 1990s. In 1998 for case, cypher-coupon issuance was $16 billion, or roughly 12% of total supply. in 2011, in contrast, there were simply three such deals in market, raising $one billion, or just 0.4% of total supply, and none since, according to LCD.

Floating rate notes

Sure deals are more attractive with a floating-rate coupon. These deals, referred to equally "floaters" or "FRNs" most often pay interest quarterly, and at a spread priced to the LIBOR rate.

This type of coupon is pop amid an surroundings of ascent interest rates, such every bit 2004 and 2005. During these years, floating charge per unit issuance increased to eight% and 12% of all new issuance, from just 1% of supply in 2003. In dissimilarity, during the low-involvement-rate environs of 2010-11, in that location were merely substantially no such issuance, at only three individual deals, equally LIBOR wallowed in a 0.25-0.five% context, co-ordinate to LCD.

PIKs/PIK toggle

Another option is for a coupon to pay "in-kind," or with additional bonds rather than cash. These deals, known as "PIK" notes, give the issuer breathing room for cash outlay, just as with zero-coupon bonds. PIKs allow a company to borrow more than coin – leverage up – without firsthand concerns about cash flow.

Thus, as with cypher-coupon newspaper, PIKs are viewed as more highly speculative debt securities. Essentially, the visitor through in-kind payment is creating more debt in a state of affairs where it doesn't take the upper-case letter to service the debt – quite the paradox.

An innovation during the cresting wave of LBO issuance in 2006 was the introduction of the PIK-toggle structure. In this example, the toggle feature gives the issuer an option to pay cash, or in kind at a higher rate, or in some cases a predefined combination of both types of payment. The issuer is frequently required to notify investors six months prior to "flipping the switch."

Retailer Neiman Marcus was the first to test the waters with a PIK-toggle deal in late 2005. A flood followed, reached a high-h2o mark in 2007. For the next few years, understandably, PIK toggle issuance was spotty, equally was the new-issue marketplace, every bit issuers frequently establish themselves in debt-restructuring way. PIK-toggle action picked upwards in 2011 and 2012 amid low involvement rates and a glut of investor case.

PIK-toggle note issuance hit roughly $12 billion in 2013 – the highest level since the meridian of the credit crisis in 2008 – merely it accounted for only iv% of full supply, versus 14% in 2008. Most issues backed dividends, though there were a few refinancing efforts. Only one backed an LBO (the 2.0 buyout of Neiman Marcus).

While one view is that a disregard of credit risk amid the achieve for yield may be sowing the seeds for the adjacent default cycle, the revival of PIK-toggle is marked by lower leverage, issuance by performing credits, and enhanced features such as shorter tenors and special phone call options or equity-clawback provisions that might flag a near-term IPO.

Moreover, "contingent toggling" has been worked into deals, with leverage and coverage tests limiting issuer ability to pay in kind. The tenor of recent deals is also shorter, at five years on boilerplate, often with a i-twelvemonth non-phone call period. The intention: These transactions effectively are short-dated instruments, and would most likely be the commencement in line to exist refinanced.

Maturity

Loftier-yield bonds by and big are arranged to mature within seven to 10 years. But, once more, at that place are exceptions. More highly speculative companies might set up a loftier coupon to attract buyers, but shorter tenors to allow for quicker refinancing. Likewise, higher-quality high-yield issuers might lock in a depression charge per unit on paper with 12-year maturity if market place conditions present such an opportunity.

Examples in 2012 include aeroplane-parts company B/East Aerospace, which placed 5% notes with 10-year tenor, and Omega Healthcare, which placed v.875% notes due in 12 years.

Phone call protection

Telephone call protection limits the ability of the issuer to phone call the paper for redemption. Typically, this is half of the term of the bonds. For case, 10-year paper will carry five years of phone call protection, and eight-year bonds cannot exist called for four years. None of this is set in stone, however, and oft these terms are negotiated amidst the underwriting procedure. Thus, the market sometimes sees seven-year (non-call iii) paper or 8-yr (not-call 5) bonds. Floating-charge per unit paper typically is callable after 1 or 2 years.

Call premiums

Call premiums come into result in one case the period of phone call protection ends. Usually, the premium on the first call date is par plus 50% of the coupon, declining ratably thereafter each twelvemonth.

An example: For 9% notes due in ten years and carrying five years of phone call protection, the bonds are callable at 104.v% of par upon the 5th year outstanding, then at 103, 101.five and par in the post-obit years, representing a par-plus-fifty% coupon, 33%, 17% and par.

A recent innovation past underwriters has been to shorten the telephone call, only residue that issuer-friendly revision past increasing the start-telephone call premium. Typically it'southward at par plus 75% of the coupon, or in the case of the 9% notes, it would exist at 106.75% of par.

Still, in the latest bull-market bicycle that'due south enduring in the outset one-half of 2015, arrangers accept finer been able to place short-call newspaper without the higher outset call premium, i.eastward., eight-year (not-phone call three) at the sometime standard, issuer-friendly first call premium of par plus 50% coupon. This ambitious issuance began peppering the market in 2010-2011 and has gained steam. During the first half-dozen months of 2015, for example, there were 39 deals arranged that way (including on 5-yr, nc2; seven-year, nc3; and eight-year, nc3) for $25.3 billion of supply, versus 55 in all of 2014 for $33 billion of supply and just 27 in 2013 for $fourteen.one billion in supply.

There have been several instances of investor push-back to the issuer-friendly structure. For case, it was revised out of VistaJet and Cliffs Natural Resources deals in early 2015, and five others in 2014. However, in contrast, super-hot deals were in some cases able to rework this structure into deals, such every bit Riverbed Technology and Valeant Pharmaceuticals in the starting time quarter of 2015, according to LCD.

Bullet notes

Bullet structure is the vernacular phrase for full-term phone call protection. Also described as non-call-life, this characteristic draws buying interest due to lower refinancing risk. All the same, bullet notes command lower relative yields, for the same reason.

Make-whole

Make-whole call premiums are standard in the investment-grade universe and prevalent in high-yield. This feature allows an issuer to avert entirely the phone call structure upshot past defining a premium to market place value that will be offered to bondholders to retire the debt early on. It'southward a call, in a sense, merely at a relatively exorbitant price. The lump sum payment program is composed of the post-obit: the earliest call toll and the net present value of all coupons that would accept been paid through the get-go call date, which is determined by a pricing formula utilizing a yield equal to a reference security (typically a U.S. Treasury note due nigh the telephone call engagement), plus the make-whole premium (typically 50 bps). An instance is IKON Part Solutions which offered to buy dorsum its 7.75% notes due 2015 amongst a takeover by investment-form suitor Ricoh. The T+50 brand-whole calculated to a toll of roughly $1,142 per bond, or essentially fourteen% more than face value.

Put provisions

Put provisions are the opposite of calls. These features allow bondholders to accelerate repayment at a divers cost due to certain events. The near common example is the change-of-control put, commonly at 101% of par. In this case, when a specific percent of the company is purchased past a third party, there is a modify in the majority of the board of directors, or other merger or sale of the company occurs, the bonds must exist retired by the issuer. This of grade would use to the example of IKON/Ricoh above, still there was no incentive to put paper at 101 because valuation had surged on the takeover news, to a 107 context. The put provision was out of the money. In some other instance, services business firm WCA Waste offered bondholders a special payment to waive the change-of-control. Direction wanted to keep the vii.5% notes in place amid a takeover past Macquarie and defend against investor puts if the bond price were to autumn below the 101 put toll, such every bit in a broad market slump.

Equity clawbacks

Equity clawbacks allow the issuer to refinance a sure amount of the outstanding bonds with proceeds from an equity offering, whether initial or follow-on offerings. A typical clawback would be for up to 35% of the outstanding bond issue for 3 years at a level equal to par, plus the coupon. Some clawbacks have come at 15%, others as high every bit twoscore%, and in rare cases the timeframe is non just three years. An example for the most typical variety: Company A raises coin via an IPO and exercises a clawback for a portion of its 10% bonds at a repurchase price of 110% of par. This is an optional redemption for the issuer and, while the investor has no say or obligation, the repayment premium is tough to disregard.

Warrants

Equity warrants often are fastened to the most highly speculative bond issues. In this case, each bail carries a defined number of warrants to purchase disinterestedness in the visitor at a later date. Ordinarily an upshot carries warrants for ownership in two-5% of the company, but fifteen-20%, while not the norm, is non unheard of for speculative start-ups.

Escrow accounts

Escrow accounts are created to comprehend a defined number of interest payments. This feature is pop with build-out transactions, such as the construction of a casino. Escrow accounts typically range from 18 months (three involvement payments) to 36 months (six coupons).

Special calls

Special calls have been innovated in recent years, including change-of-control calls provisions and mandatory prepayment. In the example of the former, which have popped upward in energy-sector deals during 2011, the premium is 110% of par for a divers menstruum of time. Mandatory prepayments have been defined most oft as 103% of par for 10% of the outcome each year for a defined flow of time. Lyondell Chemical was the first issuer to utilize the feature in November 2010. The special feature is mandatory for holders, which were notified by post. Every bit such, investors relinquished their pro rata share as per the visitor's notice of redemption.

Information technology is important to annotation that none of these features is gear up in rock. Terms of each tin exist negotiated amid the underwriting process, whether to the benefit of the issuer or investors, depending on the credit, marketplace conditions and investor preferences. A really hot bond offering might see call protection shortened by ane year, which benefits the visitor, or a tough deal could see the first call increased from par+l% coupon to par+coupon, to encourage buying interest. A struggling new issue from a commencement-upward might exist forced to tack on disinterestedness warrants to sweeten the deal, or add an escrow account to cover the first year's payments. Investors have argued abroad special calls and pushed back maturity or call protection. Information technology's all a moving target, as often times are covenants.

Covenants

Loftier-yield bond problems are by and large unsecured obligations of the issuing entity, and covenants are looser than on bank loans, providing the issuer more operating flexibility and enabling the company to avert the need for compliance certification on a quarterly ground.

The indenture includes the description of covenants. Typical covenants would entail limitations on:

- incurrence of additional debt

- payments

- dividends and payments affecting subsidiaries

- liens

- sale and leaseback transactions

- asset sales mergers or consolidation

Many times, covenants will exist reworked during the marketing process to assuage investors. Sometimes ratios and timeframes are revised, and other times unabridged covenants are added or deleted. The high-yield indenture by and large is viewed as "tighter" than that on investment-course bonds, merely looser than on bank loan indentures. Marketing of an accelerated placement from a well-known and seasoned issuer sometimes will conduct picayune or no covenants, and is referred to colloquially as having an investment-grade covenant bundle.

Bond math

Bail math includes yield to maturity, yield to call, yield to worst, current yield, elapsing, and accrued interest. See the following sections for details.

Yield to maturity

After a long period in decline following the crash of 2008-09 (past 2014 market players were saying junk bonds should no longer be chosen "high yield") the market began to turn, cheers to volatility in Europe and worries regarding the end of quantitative easing in the US (and almost ascension rates generally). Indeed, by the end of 2015'southward 4th quarter – amidst a virtual rout in junk – yields were nearing 10%. Things tin change quickly in the volatile loftier yield market, however. As investor sentiment brightened and oil prices began to rebound, yields dipped noticeably heading into 2016's second quarter.

Yield to call

Yield to telephone call is the yield on a bail assuming the bail is redeemed by the issuer at the first call date. Yield to call differs from yield to maturity in that yield to call uses a bond's call date equally the final maturity date (most often, the first telephone call date). Conservative investors calculate both a bond's yield to telephone call and yield to maturity, selecting the lower of the two as a measure out of potential return. Like yield to maturity, yield to call calculates a potential return: information technology assumes that interest income on a item bail is reinvested at its yield to telephone call rate; that the bond is held to the call date; and that the bail is called.

Yield to worst

Yield to worst is the lowest yield generated, given the stated calls prior to maturity.

Current yield

Electric current yield describes the yield on a bond based on the coupon rate and the current marketplace price of the bond (non on its face or par value). Current yield is calculated by dividing the almanac interest earned on a bond by its current market price. For example, a $1,000 bail selling for $850 and paying an viii% coupon charge per unit (or $80 per year) has a electric current yield of nine.41% (the caliber of $80 divided by $850). The coupon rate in this case is viii% (80/1,000).

Duration

Duration is a measure out of bail or bond fund's price sensitivity to changes in interest rates. Duration is defined as the weighted average term to maturity of a security's cash flows, where the weights are the present value of each cash flow as a percentage to the security's cost. The greater a bond or fund's elapsing, the greater its price volatility in response to changes in interest rates. Duration provides an estimate of a bond'south percentage toll change for a 1% modify in interest rates. For instance, the price of a bail with a duration of ii would be expected to move 2% for every ane% move in interest rates.

Accrued Interest

When in that location are bond trades that settle in betwixt coupon payment dates, the heir-apparent owes the seller interest starting from – and including – the last coupon payment date, up until – but non including – the trade'southward settlement engagement (typically t+3 for corporate bond transactions and t+1 for treasuries).

There are different day-count conventions used in the calculation of accrued interest.

- For corporates, the "30/360" 24-hour interval-count convention is generally used, which assumes xxx days in every calendar month

- For Treasuries, the "actual days" twenty-four hours-count convention is more often than not used, which factors the verbal number of days in each month

Example: To calculate the accrued involvement on a corporate bond, the formula would be

Accrued Interest = solar day count (using the xxx/360 convention) x coupon rate 10 par value

- Par Value: $100,000

- Coupon Rate: vi.l%

- Payment Dates: January/Jul 15 (JJ15)

- Trade Date: Monday, April 21st

- Settle Date: Th, April 24th

- Day Count = 16 (Jan) + xxx (Feb) + xxx (Mar) + 23 (April) = 99

Accrued Involvement = (99/360) x .065 10 100,000 = $1,787.50

Registration

High-yield bond offerings are not typically registered with the SEC. Instead, deals well-nigh ofttimes come up to market place under the exception of Rule 144A, with rights for hereafter registration once required paperwork and an SEC review is completed. A modest percentage of deals comes to market as "144A-for-life," significant without registration rights. In both cases, the issuer is not required to make public disclosures while issuing under the dominion.

Either fashion, the dominion 144A exception essentially modifies the SEC's requirement for investors to concur privately placed securities for at least two years. Instead, "qualified institutional buyers" or "QIBs" – defined under Dominion 144A as purchasers that are financially sophisticated and legally recognized past securities regulators to need less protection from sellers than most members of the public – can buy and sell these securities sans-registration.

The 144A paper is oft viewed equally a less-liquid, or harder to trade, in the secondary market given the smaller investor base. And with 144A-for-life paper, it oft commands higher premiums at pricing. However, it is a growing segment amongst the rise in hedge funds and growing issuer count. Indeed, 144A-for-life issuance in 2011 comprised 15.5% of total supply, nearly triple that of 2006, when it was v.2% of supply, according to LCD.

Deals that behave registration rights most often will exist exchanged for an identical series of registered newspaper in one case the time and try of SEC registration follows through, typically three months from issuance. This private-to-public debt commutation is not a material event for bail valuation, but registration in effect enhances the liquidity of the paper, given it is available to more investors.

Registration with the SEC takes many months, so frequent issuers will brand a shelf filing in accelerate of any market place activity. Shelf filings tin can embrace whatsoever blazon of security, or be debt-only, but in both cases the issuer may issue securities only upward to the size of the shelf filing. Shelf filings are rated in accelerate of whatever transaction.

In July 2005 the SEC put in identify "automatic registration" shelf filings. This filing is a relaxed registration process that applies to well-known, seasoned issuers (WKSIs), and covers debt securities, mutual stock, preferred stock and warrants, among other diverse instruments. A WKSI is a company that has filed all almanac, quarterly and current reports in a timely manner, and either has a greater than $700 1000000 market capitalization or has issued $one billion in registered debt offerings over the past 3 years.

Loftier-yield bond derivatives

Credit default swaps

Traditionally, accounts bought and sold bonds in the cash market through assignments and participations. Aside from that, at that place was footling constructed action exterior over-the-counter total rate of return swaps. By 2003, still, the market place for synthetically trading bond contracts was budding. Credit default swaps (CDS) are standard derivatives that have the bail as a reference instrument.

It's basically an insurance contract. The seller is paid a spread in exchange for agreeing to buy at par, or a pre-negotiated cost, a bail if that bond defaults. CDS enables participants to synthetically buy a loftier-yield upshot past going short the CDS or sell the paper by going long the CDS. Theoretically, then, a bondholder tin can hedge a position either directly (by buying CDS protection on that specific proper noun) or indirectly (past ownership protection on a comparable name or basket of names).

Moreover, the CDS marketplace provides some other way for investors to curt a bond. To do so, the investor would buy protection on a bond that it doesn't concord. If the security subsequently defaults, the buyer of protection should be able to purchase the bond in the secondary market at a disbelieve and so deliver it at par to the counterparty from which it bought the CDS contract. For instance, say an account buys five-year protection for a given bond, for which information technology pays 10% a yr. Then two years later the bond goes into default and the market price falls to fourscore% of par. The buyer of the protection tin can and so buy the paper at 80 and deliver to the counterpart at 100, a 20-point pickup.

Or instead of physical commitment, some buyers of protection may prefer cash settlement in which the divergence between the current marketplace price and the delivery price is determined past polling dealers or using a tertiary-political party pricing service. Greenbacks settlement could also be employed if in that location'south not enough newspaper to physically settle all CDS contracts on a particular security.

CDX

CDX indices are indices based on CDS obligations. These "synthetic credit indices" originated in 2001 by J.P. Morgan and Morgan Stanley, according to information-firm Markit, which acquired the indices in 2007 afterward beingness administrator and calculation agent.

The HY CDX index is an alphabetize of 100 CDS obligations that participants can trade. The index provides a straightforward mode for participants to accept long or brusque positions on a broad basket of high-yield bonds, equally well as hedge their exposure to the marketplace.

The Alphabetize is an over-the-counter product. The index is reset every six months with participants able to trade each vintage of the index that is still active. The index will be set at an initial spread based on the reference instruments and merchandise on a toll basis. Details are available online from Markit.

Co-ordinate to a related loan CDX index primer, "the two events that would trigger a payout from the buyer (protection seller) of the index are bankruptcy or failure to pay a scheduled payment on whatever debt (after a grace menses), for any of the constituents of the alphabetize."

All documentation for the index is posted here.

Author, Copyright

Copyright © 2019 by S&P Global Market Intelligence, a segmentation of S&P Global Inc. All rights reserved.

haleyafriallifuld.blogspot.com

Source: https://www.spglobal.com/marketintelligence/en/pages/toc-primer/hyd-primer

0 Response to "Defaults and Returns in the High Yield Bond Market the Year 2003 in Review and Market Outlookã¢â‚¬â"

Postar um comentário